A Finance Tech Stack, often called a FinTech Stack, combines technology tools, software, and platforms used in the finance industry to enhance and streamline various financial processes.

This stack is designed to empower financial professionals, improve efficiency, and provide valuable insights for decision-making. The components of a Finance Tech Stack can vary depending on the specific needs of a financial institution, company, or individual. This is as simple as you have read. Now, let’s get into the details.

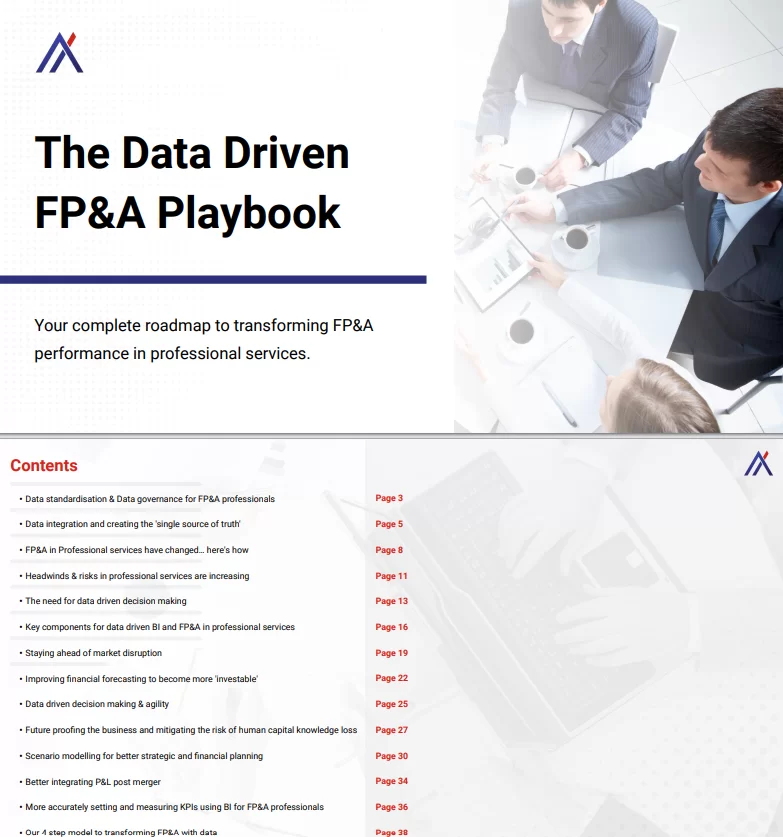

The key components commonly found in a Finance Tech Stack:

Enterprise Resource Planning (ERP) Systems: These systems integrate various financial and operational aspects of a business, providing a centralised platform for managing resources, processes, and data.

Financial Modelling Software: Tools like Anaplan, Vena Solutions, Prophix etc assist in creating dynamic financial models, conducting scenario analysis, and optimising strategic planning.

Business Intelligence (BI) Tools: Platforms such as Tableau, Power BI, or Looker transform raw financial data into visualisations and actionable insights, aiding in data-driven decision-making.

Cloud-Based Budgeting and Forecasting: Solutions like Anaplan, Vena Solutions or Prophix facilitate collaborative budgeting, forecasting, and real-time updates in a cloud-based environment.

Expense Management Systems: Tools like Concur or Expensify automate expense tracking and reimbursement processes and help manage corporate spending.

Data Visualisation Tools: Domo, Klipfolio, and others offer visually appealing dashboards and reports to communicate financial insights effectively.

Artificial Intelligence (AI) and Machine Learning (ML) Tools: These tools automate routine tasks, improve fraud detection, and provide predictive analytics. Examples include IBM Watson and DataRobot.

Financial Reporting Software: Solutions like Cognos, QuickBooks, or SAP Crystal Reports generate customisable and regulatory-compliant financial reports.

Collaboration Tools: Communication platforms such as Slack or Microsoft Teams enhance collaboration among finance teams, fostering efficient information sharing.

Blockchain for Financial Transactions: Implementing blockchain technology ensures secure, transparent, and efficient financial transactions. Ripple and Hyperledger are examples in this category.

Treasury Management Systems: Tools like Kyriba or TreasuryXpress optimise cash management, liquidity, and risk for businesses with complex financial transactions.

A well-constructed Finance Tech Stack is tailored to the specific needs and goals of the financial entity, whether it’s a bank, financial institution, or a corporate finance department.

By integrating these tools, you aim to improve operational efficiency, enhance data accuracy, and enable finance professionals to navigate the complexities of financial management with agility and precision.

But how is it related to FP&A?

A Finance Tech Stack is closely related to Financial Planning and Analysis (FP&A) as it is the technological foundation for conducting, optimising, and enhancing the various tasks associated with FP&A processes.

FP&A involves strategic financial planning, budgeting, forecasting, and analysis to support informed decision-making within an organisation. The Finance Tech Stack provides the tools and technologies necessary to streamline these processes, making them more efficient and effective.

Here’s how the Finance Tech Stack is interconnected with FP&A:

Financial Modelling Software:

● Financial modelling is a core element of FP&A, aiding in creating detailed projections and scenario analysis. Financial modelling software in the stack assists FP&A professionals in building and optimising these models.

Business Intelligence (BI) Tools:

● BI tools help FP&A teams visualize and analyse financial data, providing insights for better decision-making. Dashboards and reports generated by BI tools enhance the analytical capabilities of FP&A professionals.

Cloud-Based Budgeting and Forecasting:

● Cloud-based budgeting and forecasting tools enable collaborative planning, real-time updates, and access to the latest financial information. This is crucial for FP&A teams to adjust strategies based on the most current data.

Expense Management Systems:

● Expense management is vital to budgeting and financial planning. Integrating expense management systems into the Finance Tech Stack ensures accurate tracking of expenses, a key aspect of FP&A.

Data Visualisation Tools:

● Data visualisation tools enhance the communication of financial insights. This is particularly valuable for FP&A professionals who must convey complex financial information clearly and understandably to stakeholders.

Artificial Intelligence (AI) and Machine Learning (ML) Tools:

● AI and ML tools automate routine tasks, improve forecasting accuracy, and provide predictive analytics. In FP&A, these tools can be employed to analyse historical data, identify trends, and support more accurate financial projections.

Financial Reporting Software:

● Financial reporting software ensures that FP&A professionals can efficiently generate accurate and compliant reports. This is crucial for conveying financial performance to stakeholders and executives.

Collaboration Tools:

● Collaboration tools facilitate communication and coordination among FP&A teams, especially when multiple stakeholders are involved in the financial planning and analysis process.

Blockchain for Financial Transactions:

● Blockchain technology ensures secure and transparent financial transactions. This is particularly relevant in FP&A, where accuracy and transparency in financial data are paramount.

Treasury Management Systems:

● Treasury management systems optimise cash management and liquidity, providing FP&A professionals with the tools to make informed decisions about financial resources.

By integrating these components into a Finance Tech Stack, organisations enhance the capabilities of their FP&A teams, fostering agility, accuracy, and strategic insight in financial planning and analysis processes.

The Finance Tech Stack essentially acts as an enabler, empowering FP&A professionals to navigate the complexities of financial management with greater efficiency and precision.

Once, in my latest webinar, I was asked a question about Tech Stack, and I understood that professionals need help in aligning their businesses with this term and how incredible it is to have them ask a few major questions around this and provide a direction that is much needed at this hour.

In case you are looking to connect and understand more, just book a call with my team – https://aksharconsulting.co.uk/contact

And now,

Are there any pros of understanding Tech Stack in FP&A?

Understanding the Tech Stack in FP&A offers numerous advantages, empowering finance professionals to navigate the complexities of financial planning and analysis with greater efficiency, accuracy, and strategic insight.

Here are several pros of having a solid understanding of the Tech Stack in FP&A:

Enhanced Efficiency:

● Automation: A well-constructed Tech Stack automates routine tasks, allowing finance professionals to focus on more strategic and value-added activities. This leads to increased efficiency and a reduction in manual work.

Improved Accuracy:

● Integrated Data: The Tech Stack facilitates seamless integration of financial data from various sources, minimising the risk of errors associated with manual data entry. This ensures accuracy in financial reporting and analysis.

Real-Time Insights:

● Cloud-Based Solutions: Cloud-based tools enable real-time collaboration, updates, and access to the latest financial information. Finance professionals can make informed decisions based on current data, fostering agility in response to market changes.

Streamlined Collaboration:

● Collaboration Tools: Tech Stack components like collaboration tools enhance communication and coordination among FP&A teams, ensuring everyone is on the same page. This leads to improved collaboration and a more cohesive approach to financial planning.

Strategic Planning and Forecasting:

● Financial Modeling Software: Understanding and utilising financial modeling software enhances the ability to conduct strategic planning, scenario analysis, and forecasting. This is crucial for developing robust financial strategies and anticipating potential challenges.

Data Visualisation for Better Communication:

● Data Visualisation Tools: Visualisation tools translate complex financial data into clear, understandable visual representations. This aids in the effective communication of financial insights to both finance and non-finance stakeholders.

Enhanced Security:

● Blockchain Technology: Integrating blockchain for financial transactions ensures secure, transparent, and tamper-resistant transactions. This enhances the security of financial data, a critical consideration in FP&A.

Mobile Accessibility:

● Mobile Financial Apps: Mobile financial apps provide on-the-go access to critical financial information. Finance professionals can stay connected and make informed decisions regardless of location.

Adoption of AI and ML:

● AI and ML Tools: Incorporating AI and ML tools automates data analysis, improves forecasting accuracy, and identifies patterns in financial data. This leads to more informed and data-driven decision-making.

Compliance and Reporting:

● Financial Reporting Software: Financial reporting software ensures that reports are accurate, compliant with regulations, and can be generated efficiently. This is crucial for meeting regulatory requirements and maintaining transparency.

Optimized Cash Management:

● Treasury Management Systems: Treasury management systems optimize cash management and liquidity, providing finance professionals with the tools to make informed decisions about financial resources.

Scalability and Adaptability:

● Containerization and Orchestration: Utilising containerization and orchestration technologies allows for scalability and adaptability in deploying and managing applications, supporting growth and changes in FP&A requirements.

A deep understanding of the Tech Stack in FP&A equips finance professionals with the tools and technologies needed to drive efficiency, accuracy, and strategic decision-making.

As financial landscapes evolve, staying abreast of technological advancements ensures that FP&A teams are well-equipped to meet the challenges of today’s dynamic business environment.

How is it going to help a business today?

Adopting a robust Finance Tech Stack is a right fit for businesses today due to several compelling reasons that align with the dynamic nature of the modern business landscape. Here’s why it’s a suitable choice for any business:

● Data-Driven Decision-Making

● Efficiency and Productivity

● Agility and Adaptability

● Global Connectivity

● Enhanced Collaboration

● Competitive Edge

● Compliance and Security

● Strategic Financial Planning

● Customer-Centricity

● Adoption of Emerging Technologies

● Operational Cost Savings

● Remote Work Facilitation

In conclusion, a Finance Tech Stack aligns with the needs of businesses today by providing the technological infrastructure necessary for agility, efficiency, data-driven decision-making, and strategic financial management.

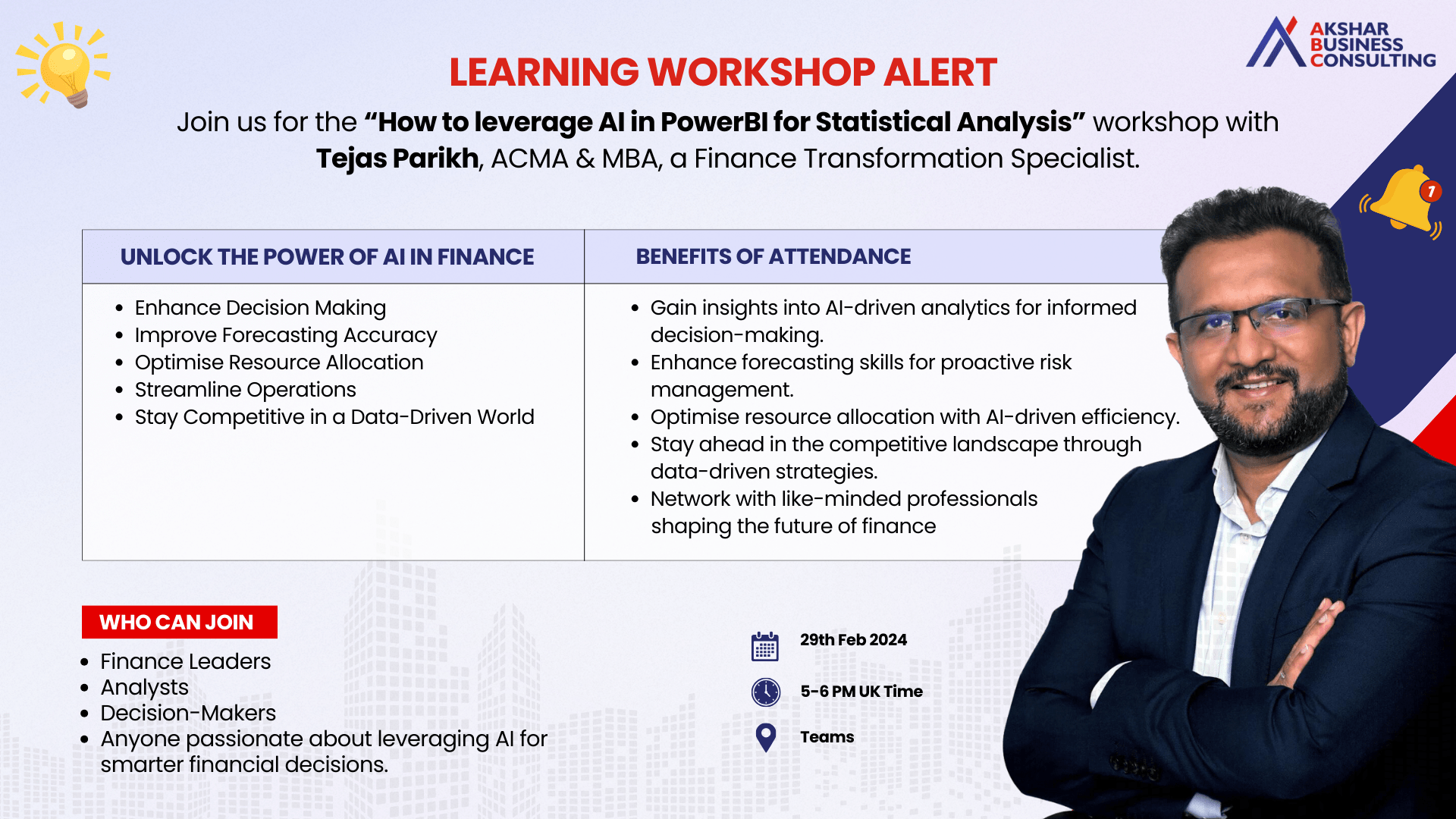

Learn more about Finance Tech stack in our latest workshop: “How to leverage AI in PowerBI for Financial Analysis”

It positions businesses to not only thrive in the current landscape but also to navigate the uncertainties and challenges of the future.